There are now more than half a billion mobile money accounts in the world, mostly in Africa — here's why this matters

Mobile money allows people without banks to securely transfer funds via text message, and its adoption is growing rapidly.

By the end of today, you'll probably have used your bank account — maybe to buy groceries, pay rent, or send money to a friend. Even better, to receive your salary. It's something many of us take for granted.

However, for more than a billion people globally, transactions only happen with cash.1 That means carrying around physical notes and coins, traveling long distances just to send or receive money, and facing the constant risk of losing it or having it stolen. The absence of formal banking services adds yet another hurdle for people trying to escape poverty.

But in recent years, “mobile money” has transformed how many people access financial services. Mobile money differs from traditional bank accounts; you don’t need a physical bank branch or even an Internet connection. Instead, you use text messages for services like deposits, transfers, and payments via a mobile phone.2 In this sense, it’s not the same as standard Internet banking, which many of us now use for most transactions.

Many people might be unfamiliar with how mobile money works, so let me briefly explain. You dial a short code for the mobile money provider, choose “send money”, and enter the recipient’s phone number (which serves as their account number). Next, type the amount and your secure PIN.3 That’s it — both the sender and recipient get an SMS confirmation within seconds. If you need to add funds to your mobile money account or retrieve your PIN, you can visit a local mobile money agent, often found in small shops or kiosks, which can be easier to reach than traditional banks.

In this article, I'll look at how mobile money opens up new opportunities for bank account ownership in developing countries and why this matters.

More than half of mobile money accounts are in Sub-Saharan Africa

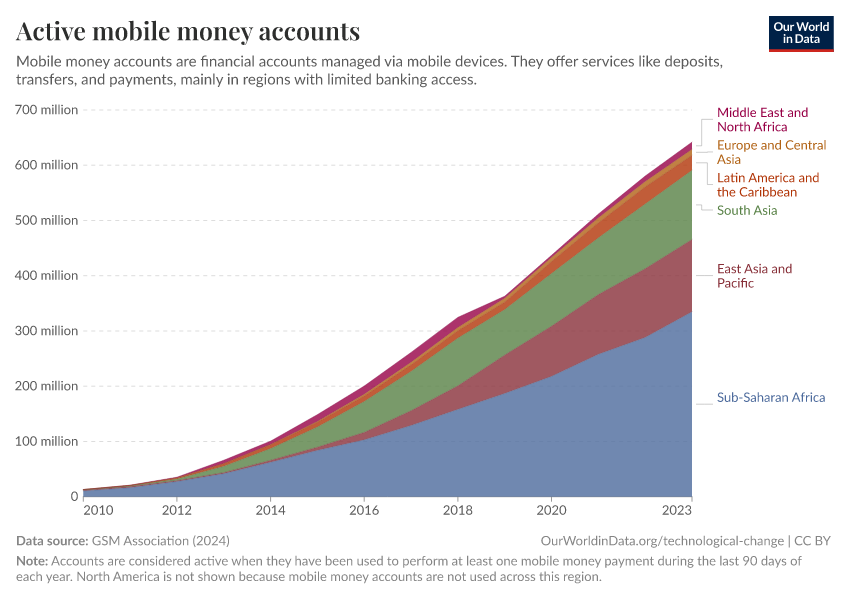

In 2010, there were just 13 million mobile money accounts in the world, fewer than the population of my home country, the Netherlands. By 2023, this had reached more than 640 million. That’s more than twice the total number of Netflix subscriptions worldwide.4 You can see this growth in the chart below.

What’s immediately obvious is how much of this growth has come from Sub-Saharan Africa; it’s home to more than half of the world’s accounts. In 2023, there were over 330 million active mobile money accounts in the region; more than one mobile money account for every four people.5

What’s changed? One of the obvious drivers of this growth has been the widespread adoption of mobile phones, not just in the richest countries but across the globe. Mobile subscriptions have surged in nearly every region.

But the total number of mobile money accounts doesn’t tell us what percentage of people use mobile money. A small portion of people could each have many accounts. So instead of examining absolute numbers, let's look at the share of people with mobile money accounts in Sub-Saharan Africa.

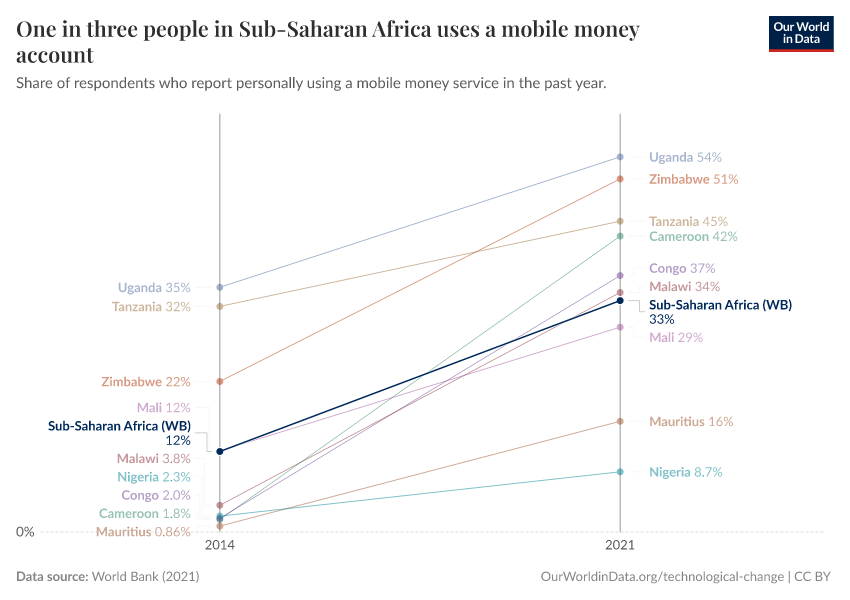

As the chart below illustrates, the percentage of people in Sub-Saharan Africa with a mobile money account grew rapidly, from 12% in 2014 to 33% by 2021.

The chart also highlights trends in a few specific countries: in Ghana and Uganda, mobile money has become the norm, with most people now using it. Adoption in Nigeria and Mauritius has been slower but continues to follow an upward trajectory. I'll explore the reasons behind these differences in adoption later.

There’s good reason to focus on Sub-Saharan Africa here, both in terms of how quickly mobile money has grown there (it hosts more than half of all accounts) and the financial benefits it could bring (the region is home to over two-thirds of the global population living in extreme poverty).

Mobile money boosts bank account ownership in Sub-Saharan Africa

There are two main types of overall bank accounts: those at traditional financial institutions, like banks, and mobile money accounts. Some individuals exclusively use institutional accounts, others rely solely on mobile money, while many use both. How has this surge of mobile money across Sub-Saharan Africa affected overall bank account ownership?

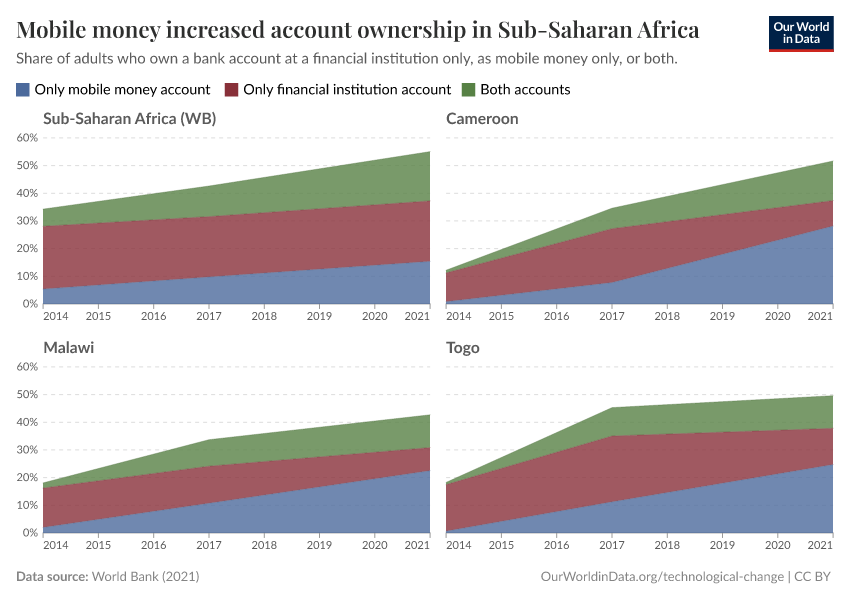

The chart below illustrates how mobile money has contributed to the growth of total account ownership in Sub-Saharan Africa and across three countries.

In 2014, one-third of adults in Sub-Saharan Africa had a bank account. By 2021, this had increased to more than half. But as you can see in the chart, the share that only had an account at a financial institution did not change over that period — the line is flat, at 22%. That means that almost all of the growth in this share has come from those getting a mobile money account (either on its own or alongside one from a financial institution).

In Malawi, a low-income country in Sub-Saharan Africa, the percentage of people with any kind of bank account more than doubled between 2014 and 2021, largely because of a rapid increase in mobile money accounts. For every person with a mobile money account in 2014, more than eight people had one by 2021.

In Togo, the share of individuals with financial institution accounts, including those combined with mobile money, even declined between 2017 and 2021, while mobile money usage more than doubled. In other words, mobile money doesn’t just help people access financial services for the first time; it also offers a preferred alternative for some people already using traditional accounts.

In Sub-Saharan Africa, more people now receive wages through their mobile phones than through traditional bank accounts.6

Having a bank account might seem basic, but rising ownership is changing employment, safety nets, and aid systems

Why does this rapid development matter? Most of us probably think of our bank accounts as boring services — possibly even a chore to manage — but the ability to easily deposit and transfer money via a mobile phone unlocks life-changing opportunities for many.

Bank accounts are gateways to the formal financial system. They provide two essential things everyone needs: a secure place to store money and a simple way to send or receive payments. Here are three ways this technology makes a difference.

Flexibility: more freedom to work or study where you want

When sending and receiving money becomes easier, people can make different decisions about where and how they earn a living.7 If you exclusively handle money in the form of cash, you need to be close to your family if you want to give them money often and easily. You can’t move to a town or city far from your home village.

This geographical constraint disappears if you know you can send money home cheaply and reliably.8 Mobile money reduces the cost and difficulty of doing that, resulting in more people making the move.

In rural Mozambique, researchers ran an experiment to understand the impact of mobile money on employment. With access to mobile money services, more people started moving from rural villages to cities, with a higher probability of finding a job with higher wages than farming.9 These results have been replicated in other studies.10

New job opportunities don’t just provide employment; they allow people to escape poverty and purchase small comforts beyond mere necessities. A 2016 study in Science found that Kenya's M-PESA mobile money system increased household consumption levels and lifted 194,000 households (about 2% of all Kenyan households) out of extreme poverty.11

Access to bank accounts helps people support loved ones within countries and across continents and oceans. As my colleague Tuna Acisu and I showed in another article, the money migrants send back to their home countries is more than three times the amount that comes from international aid. Most of these funds flow from wealthier to poorer nations, and the costs of sending this money continue to drop.

Mobile money doesn’t just help people manage the income they already have; it also opens up better ways to earn and distribute it.

Safety net: risk spreading against unexpected income shocks

I’ve discussed how mobile money helps people study or work elsewhere while continuing to support their families through regular transfers. But there's another, perhaps less visible way mobile money protects people in developing countries: as a shield against unexpected income shocks.

Life throws curveballs. Your business crumbles overnight. The job you counted on vanishes. The crops you carefully nurtured yield half what you expected. These unexpected income shocks are severe disruptions for those living in poverty; small financial shifts can determine whether schooling or healthcare is affordable.

When limited to cash, only those physically close can help during unexpected crises. They must physically hand you money when you need it most. Mobile money changes this dynamic: with a simple message, you can reach family or friends miles away, borrowing just enough to maintain stability when times are tough.

A 2014 study in a top economic journal found that households without access to mobile accounts typically cut their spending by around 7% when hit with income shocks. In families with mobile accounts, consumption remained steady, protected by their ability to quickly receive support.12 Other studies found similar results with sudden health expenses.13

Mobile money is a practical safety net, helping families weather financial uncertainties.

Aid: support from people in rich countries is now easier and cheaper

So far, I’ve focused on transfers within lower-income countries themselves. However, mobile banking is also changing how people in wealthy countries can support people in the poorest ones. With a few taps on a phone, aid money travels directly to those who need it most, bypassing expensive middlemen and complicated logistics.

Foreign aid has saved millions of lives. The USAID’s PEPFAR program alone is estimated to have prevented 25 million deaths from HIV14, and foreign aid has helped the world close in on the eradication of polio — a disease that used to paralyze hundreds of thousands of children each year.

But aid delivery hasn’t always been efficient.15 It can be hampered by expensive administration, flawed designs, and occasionally corruption, though the latter is less widespread than commonly believed.

Mobile money offers a simpler path. Organizations like GiveDirectly use mobile money to send cash directly to recipients' phones. For every $100 donated, $89 reaches families in need.

Some aid organizations combine these direct cash transfers using mobile money with basic support services — a productive asset (like livestock or a tool) and some training. These so-called "big push programs" produce lasting changes in people's lives.16

While mobile money creates powerful changes within countries — opening job opportunities, connecting families, and protecting against unexpected hardship — it also improves global development efforts.17

Without phones or IDs, many can't access mobile money

The adoption of mobile money has grown quickly in some countries (like Ghana) while progress has been much slower in others (like Nigeria). To help more people gain access to financial services, it’s important to understand the reasons behind these differences.

One major barrier to using mobile money is still not having a mobile phone. The Global Findex 2021 survey asked adults without bank accounts why they don’t use mobile money. A lack of money was the top reason. But the next most common was the absence of a mobile phone (probably related to a lack of money). While three-quarters of Sub-Saharan Africans in the survey now own phones, many countries still have low ownership rates.18

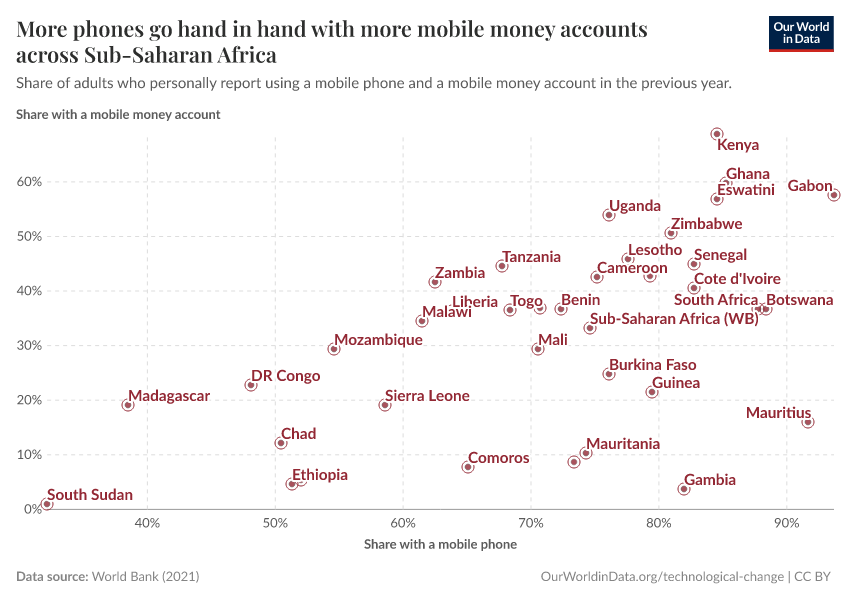

The chart below shows the share of adults with a mobile money account against the share of adults with a mobile phone for countries in Sub-Saharan Africa. The two are positively correlated: unsurprisingly, people in countries with more phones are more likely to use mobile money.

Access to affordable phones is key to improving financial inclusion in low-income countries. However, there’s another surprising challenge: the lack of necessary documentation.

In Sub-Saharan Africa, 13% of adults without bank accounts said they didn’t use mobile money because they didn’t have the required documents.18 This was a bigger barrier than the distance to mobile money agents, or even the lack of a mobile phone in some countries.

Many people in Sub-Saharan Africa still lack formal identification. The World Bank found that in seven Sub-Saharan African countries, fewer than 60% of adults have an ID. In Togo, only 40% of adults have one.

Reasons for this include not having a birth certificate, high fees for obtaining IDs, or the difficulty of traveling to registration offices. Making it easier and cheaper to get an ID could boost access to mobile money and help people find jobs, receive medical care, and vote.

Alternatively, mobile money providers and network providers could explore tiered verification systems, allowing basic mobile money accounts with lower transaction limits using minimal documentation, while requiring full identification only for higher-value services.

Just over a decade of progress with mobile money, and still much to do

In just over a decade, mobile money has achieved what traditional banking couldn't do in centuries: give bank accounts to billions of people in rural areas in developing countries. This technology changes how people manage their money, pursue better opportunities, and support each other.

Still, more than one billion people rely exclusively on cash. Many of them live in the poorest regions and in remote areas, where they could benefit most from financial inclusion. If the evidence presented in this article shows anything, it's that there remains huge untapped potential for improving lives when these people gain access to basic financial services.

Acknowledgments

Thanks to Hannah Ritchie, Saloni Dattani, and Edouard Mathieu for their feedback and comments on this article, and to the World Bank for publishing this insightful article, which sparked my interest.

Two billion people don’t have safe drinking water: what does this really mean for them?

For billions, it can mean hours spent collecting water. For almost a million, it means dying from disease.

The number of people without electricity more than halved over the last 20 years

The world has made significant progress on improving electricity access.

What is economic growth? And why is it so important?

The goods and services that we all need are not just there; they need to be produced. Growth means that their quality and quantity increase.

Endnotes

”Over 80% of the world's 1.4 billion adults without financial accounts reside in places at risk from climate, intensifying their susceptibility to economic and environmental shocks.” World Bank

”Similar to prepaid credit, mobile money enables convenient electronic money transfers. The mobile phone number is linked to the bank account. This also means that the ability to make financial transactions is not reliant on Internet access. A mobile phone signal is all that’s required.” Nevis

Reuters, Netflix signals confidence with upbeat revenue outlook.

The estimated population of Sub-Saharan Africa in 2023 was 1.26 billion, according to the World Bank.

World Bank, Financial Inclusion Overview.

In 2021, more than half of all mobile money users in Sub-Saharan Africa used their accounts to send or receive money from family members elsewhere in their country.

”To explain the negative impact of mobile money on agricultural activity and investment, we conjectured this effect may be due to an increase in migration out of rural areas. This may be the result of the substantial decrease in the transaction costs associated with sending migrant remittances to rural areas, leading not only to an increase in the value of migrant remittances received by treated rural households, as learnt from our empirical analysis, but also to increased incentives to move away from rural to urban areas – where there is a higher probability of finding a more productive occupation.” Batista, C., & Vicente, P. C. (2023). Is mobile money changing rural Africa? Evidence from a field experiment. Review of Economics and Statistics, 1-29.

Batista, C., & Vicente, P. C. (2023). Is mobile money changing rural Africa? Evidence from a field experiment. Review of Economics and Statistics, 1-29.

A similar pattern showed up in a randomized control trial in Uganda. In rural regions far away from bank branches, people who gained access to mobile money were more likely to get a job outside of farming. The share of people in non-farm self-employment almost doubled — from 3.4% to 6.4%. At the same time, severe food insecurity fell: the share of households with very low food security dropped from 63% to 47%.

In Kenya, researchers tracked what happened as the mobile money system M-PESA expanded across the country. In places with better access to mobile money agents, women began shifting away from traditional farming. Between 2008 and 2014, an estimated 185,000 women moved into small-scale retail.

Suri, T., & Jack, W. (2016). The long-run poverty and gender impacts of mobile money. Science, 354(6317), 1288-1292.

Suri, T., & Jack, W. (2016). The long-run poverty and gender impacts of mobile money. Science, 354(6317), 1288-1292.

Jack, W., & Suri, T. (2014). Risk sharing and transactions costs: Evidence from Kenya's mobile money revolution. American Economic Review, 104(1), 183-223.

Research shows that people who experienced negative health shocks without M-PESA often had to make painful sacrifices – cutting non-food expenses and even withdrawing their children from school to cover these costs. Those with mobile money accounts, however, could spend more. Similar results have been documented in randomized control trials in Mozambique and Uganda. Sources: - The Abdul Latif Jameel Poverty Action Lab - Suri, T., Jack, W., & Stoker, T. M. (2012). Documenting the birth of a financial economy. Proceedings of the National Academy of Sciences, 109(26), 10257-10262. - Jack, W., & Suri, T. (2014). Risk sharing and transactions costs: Evidence from Kenya's mobile money revolution. American Economic Review, 104(1), 183-223.

HIV.gov, What is PEPFAR?

When Rory Stewart served as Britain’s development minister, he uncovered alarming inefficiencies — like projects costing £40,000 that delivered just £2,000 in real impact. That’s a 95% loss in value.

Randomized control trials across several countries found that participant households experienced considerably more food consumption, higher income, increased work hours, improved mental health, and greater political involvement, with all these benefits persisting after two years. What’s especially compelling is that these programs often generate more value than they cost. Abhijit Banerjee et al., A multifaceted program causes lasting progress for the very poor: Evidence from six countries. Science 348, 1260799 (2015). DOI: 10.1126/science.1260799

You might wonder whether these programs truly contribute to development in a broader sense. Consider this: helping people move beyond mere survival is often necessary for broader development to take root. The evidence clearly shows these programs lift people out of extreme poverty and dramatically improve the lives of the poorest, creating a foundation for further progress.

World Bank, Data From the Global Findex 2021: The Impact of Mobile Money in Sub-Saharan Africa.

Cite this work

Our articles and data visualizations rely on work from many different people and organizations. When citing this article, please also cite the underlying data sources. This article can be cited as:

Simon van Teutem (2025) - “There are now more than half a billion mobile money accounts in the world, mostly in Africa — here's why this matters” Published online at OurWorldinData.org. Retrieved from: 'https://archive.ourworldindata.org/20251125-173858/mobile-money-why-it-matters.html' [Online Resource] (archived on November 25, 2025).BibTeX citation

@article{owid-mobile-money-why-it-matters,

author = {Simon van Teutem},

title = {There are now more than half a billion mobile money accounts in the world, mostly in Africa — here's why this matters},

journal = {Our World in Data},

year = {2025},

note = {https://archive.ourworldindata.org/20251125-173858/mobile-money-why-it-matters.html}

}Reuse this work freely

All visualizations, data, and code produced by Our World in Data are completely open access under the Creative Commons BY license. You have the permission to use, distribute, and reproduce these in any medium, provided the source and authors are credited.

The data produced by third parties and made available by Our World in Data is subject to the license terms from the original third-party authors. We will always indicate the original source of the data in our documentation, so you should always check the license of any such third-party data before use and redistribution.

All of our charts can be embedded in any site.